The International Construction Market Survey (ICMS) from global professional services consultancy Turner & Townsend shows record cost escalation across global real estate. On the back of rising demand and the release of pent-up investment, 30.7 percent of city markets are reporting construction inflation for 2022 of 10 percent or more, with no correction or fall in costs expected soon.

In a year of rapid and sustained inflation, US cities dominate the rankings of the most expensive places in the world for real estate development, as overheating markets threaten to curtail burgeoning pipelines post-pandemic.

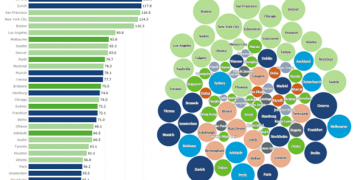

Increasing inflationary pressures are also impacting the cost to build. Each year, we produce a global ranking of the average cost to build in each market. In 2022, the most expensive market to build is San Francisco at US$4,729/m². Tokyo has moved from first to second most expensive this year, closely followed by Osaka, which is a new addition in this year’s survey.

In our top 10, there are four markets in North America, including New York, which is ranked fourth, Boston in eighth position and Los Angeles in ninth position. We have seen a big shift in positioning for North American markets, which is primarily due to the strengthening of the USD, higher building material costs driven by supply-chain disruptions, and the region’s high labour costs.

John Robbins, Managing Director for the U.S. and North American Head of Real Estate, Turner & Townsend said: “In San Francisco, construction demand is continuing to be led by increasing requirements for new mixed-use real estate from Google, Apple, Facebook and other tech companies throughout the Bay Area.

Housing demand in this location also remains at an all-time high. This is led partly by projects delayed during the pandemic, but also by the acute shortage in housing stock. The rate of development is especially high on the Peninsula and in San Jose, with Google, for example, delivering residential buildings as part of a corporate drive towards meeting high affordable housing demand.

Over on the east coast, New York is continuing to experience a race to the skies with demand for new supertall towers. In addition, Mayor Adams has promised to ‘supercharge’ economic development, loosening zoning regulations while committing to new apartment building across the five boroughs. A focus on zero carbon is also leading an emerging retrofit market for existing buildings.

A common feature across both cities is the greater competition that they face to retain skilled labor. New York is undoubtedly competing to retain construction talent, with tertiary markets such as Austin and Phoenix, and rural areas in states such as Kentucky and Georgia, where there’s been a surge in new industrial development for battery factories and semiconductor plants. San Francisco still remains highly reliant on imported labor from neighbouring states to satisfy demand.”

Key challenges – Reinforced challenges

With many markets in 2021 accelerating out of recession and growing rapidly in a short period of time, the challenges once faced by the global construction sector are evolving. We asked our market experts, each located in a different part of the world, to rate the degree of impact that certain challenges are having on their local construction markets.

The top three challenges reported in this year’s survey are rising costs of construction, excessive lead times and skilled labour shortages. These constraints are having a significant impact on construction markets around the world and are a common theme when gaging local market sentiment from our regional experts.

Super sectors lead post-pandemic growth

The report points to a number of key sectors as driving growth – and costs – across global real estate. The top performing sector for 2022 is industrial, manufacturing and distribution space, led by the vast growth in e-commerce as well as pharmaceuticals manufacturing.

In second and third places are residential and social housing, and transport (road rail and ports) – which last year were placed fourth and second respectively. Housing has benefited from a period of historically low interest rates, though as central banks now act to curb inflation a softening in the market is expected.

A notable jump has been seen in commercial office development, which rose from fifteenth place in 2021 to fifth this year – an indicator of the returning demand for office space post-pandemic.

Construct America Magazine | The Home of Construction Industry News